Paper Money is Dead: Why Bitcoin is Redefining the Global Economy Through Cryptography

October 4, 2024

The Dark Side of Money: Historical Financial Collapses That Shattered Trust in Fiat Currency

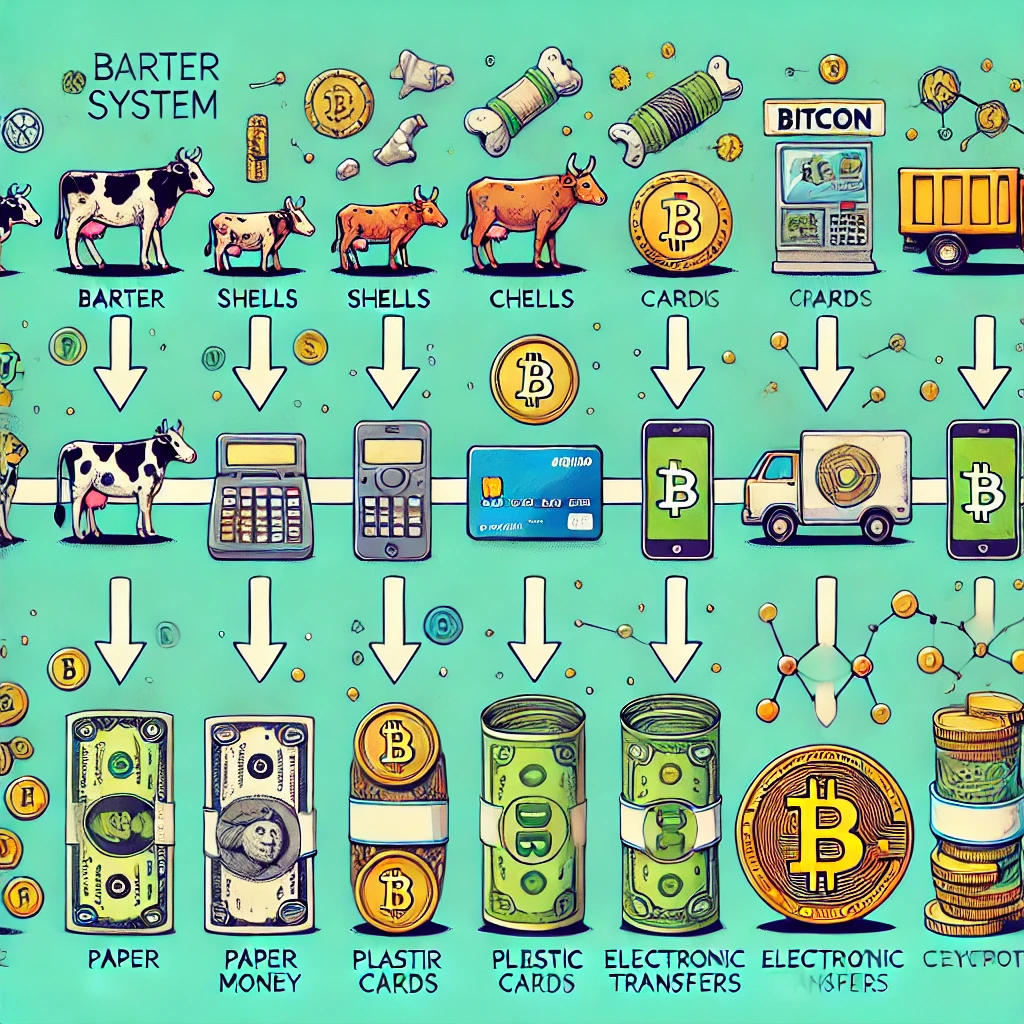

October 10, 2024Evolution of Money: From Barter to Bitcoin

From trading livestock and gold coins to exchanging digital assets and cryptocurrencies, the evolution of money is filled with unexpected turns. But while most people take their daily transactions for granted, the history behind what we now call “money” is complex and often counterintuitive. This article will guide you through the remarkable journey of money, showing how each transformation was not just a change in medium but a revolution in how society understood value and trust.

1. Physical Objects (6000 B.C.): When Stones and Shells Were Money

Most people would never guess that at one point in history, money looked more like a collection of seashells or a pile of shiny stones. Early societies used objects with symbolic value as a means of trade. These items had no intrinsic worth but were accepted because of their rarity and the shared belief in their value.

- Key Points: Symbolic value, not practical utility, established the first form of “currency.”

- Downside: Heavy, cumbersome, and not standardized.

- Impact: The first step in human societies agreeing on what represents value.

2. Barter System (5000 B.C.): Why Trading Cows for Wheat Didn’t Last Long

The barter system might seem simple — exchanging goods directly for other goods. But it had a fundamental flaw: you needed to find someone who not only had what you wanted but also wanted what you had. This “double coincidence of wants” made bartering inefficient and frustrating.

- Key Points: Useful in small, simple communities but chaotic on a larger scale.

- Downside: No standardized value, making complex trades nearly impossible.

- Impact: Led to the search for something that everyone valued — enter precious metals.

3. Gold (4000 B.C.): The Original Gold Standard, Before It Was Cool

Gold isn’t just pretty; it was the first form of standardized money. Its rarity, durability, and divisibility made it a perfect candidate to represent value. For the first time, people didn’t need to trade cows or grains — they had a universal medium that everyone wanted.

- Key Points: Portable, divisible, and universally accepted.

- Downside: Hard to carry in large quantities; susceptible to theft.

- Impact: Paved the way for more sophisticated financial systems and laid the groundwork for the gold standard.

4. Metal Coins (7th Century B.C.): The Birth of the First “Cash”

In the ancient kingdom of Lydia (modern-day Turkey), around the 7th century B.C., the first metal coins were created. Unlike gold chunks, these coins had a standard weight and were stamped with a seal to guarantee authenticity. It was a game-changer.

- Key Points: Standardized value, guaranteed by the ruling authority.

- Downside: Easy to counterfeit and dependent on governmental trust.

- Impact: Made trade faster and more reliable, allowing empires to expand their economies.

5. Paper Money (812 A.D.): When Governments Printed Value out of Thin Air

While it seems normal today, the concept of paper money was once radical. Introduced by the Chinese during the Tang Dynasty, paper money was a promise to pay a value held elsewhere (usually in gold or silver). This innovation made large transactions much easier but required people to believe in a piece of paper’s value.

- Key Points: Lightweight, easy to produce, and standardized.

- Downside: Prone to inflation if overprinted, easily damaged.

- Impact: Freed economies from the constraints of physical currency, leading to unprecedented economic growth.

6. Plastic Cards (1928): How a Piece of Plastic Became the Gateway to Debt

Most people think of plastic cards as convenient — but did you know they were initially used to track spending in the Prohibition era? The first “credit cards” were issued in 1928 and evolved into modern credit and debit cards. This innovation changed consumer behavior forever, making it easier to spend money you didn’t have.

- Key Points: Eliminated the need to carry cash, enabling instant payments.

- Downside: Encouraged overspending, leading to debt traps.

- Impact: Created the modern consumer economy and revolutionized personal finance.

7. Electronic Money (1994): The Era of Clicks, Not Coins

With the rise of the internet, money became even more abstract. Electronic transfers and online banking meant that people no longer needed to see or touch their money. It existed as digits on a screen, ready to be moved with a single click. This shift opened the doors to global finance, connecting economies like never before.

- Key Points: Instant, borderless transactions without physical presence.

- Downside: Prone to cybercrime and requires robust digital infrastructure.

- Impact: Set the stage for e-commerce, digital banking, and the globalization of finance.

8. Cryptocurrency (2009): Why Bitcoin is More Than “Just Digital Money”

Most people think of Bitcoin as digital money — but it’s far more disruptive than that. Launched in 2009 by the mysterious Satoshi Nakamoto, Bitcoin introduced a completely decentralized financial system. For the first time, people could exchange value without needing banks, governments, or any middlemen.

- Key Points: Trustless, decentralized, and limited supply (21 million coins).

- Downside: High volatility, regulatory uncertainty, and still in early adoption.

- Impact: Bitcoin isn’t just changing money — it’s redefining how we think about trust, ownership, and freedom in the digital age.

Conclusion: Money is Dead, Long Live Money!

The journey of money has been filled with surprising twists and turns. What started as physical objects has become something intangible and digital. But one thing remains constant: the human need to find better ways to represent value and build trust. As cryptocurrencies continue to grow, we might just be witnessing the beginning of the next chapter in the story of money — one where centralized banks and paper notes are mere relics of the past.